The Amazon “Shopping Basket” is the Wrong Term

What does the typical Amazon customer buy on the average trip?

Even asking the question reveals how Amazon has changed retail shopping. Generations of retailers and their investors have analyzed the “shopping basket”. What mix of products does a customer buy, say on a trip to the supermarket? Or Walmart, Ulta, or Best Buy? How can a retailer increase the number of items tossed in the cart on a given shopping trip? For Amazon, even the word “trip” is misplaced.

We can look at the average order for Amazon, although right away we run into fundamental differences between Amazon and other retailers. Earlier we showed how Amazon operates as much as a convenience store as it does any other type of retailer. We return to that analysis and find that the Amazon shopping basket looks much different from other retailers. Amazon customers buy many fewer items and spend somewhat less per trip than you might expect, Yet, as a shopping destination Amazon continues to meet both day-to-day needs, such as groceries, and more occasional ones, like electronics and apparel.

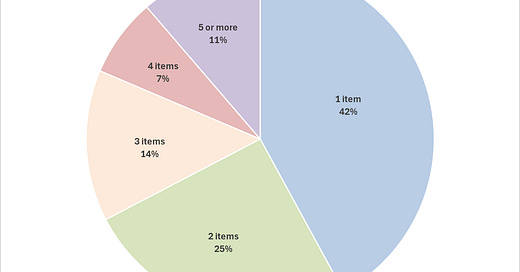

Almost two-thirds of Amazon customers buy only one or two items in a given visit (Chart 1). It seems customers make repeat orders from Amazon.com as needs arise, rather than bunding several purchases in the same transaction.